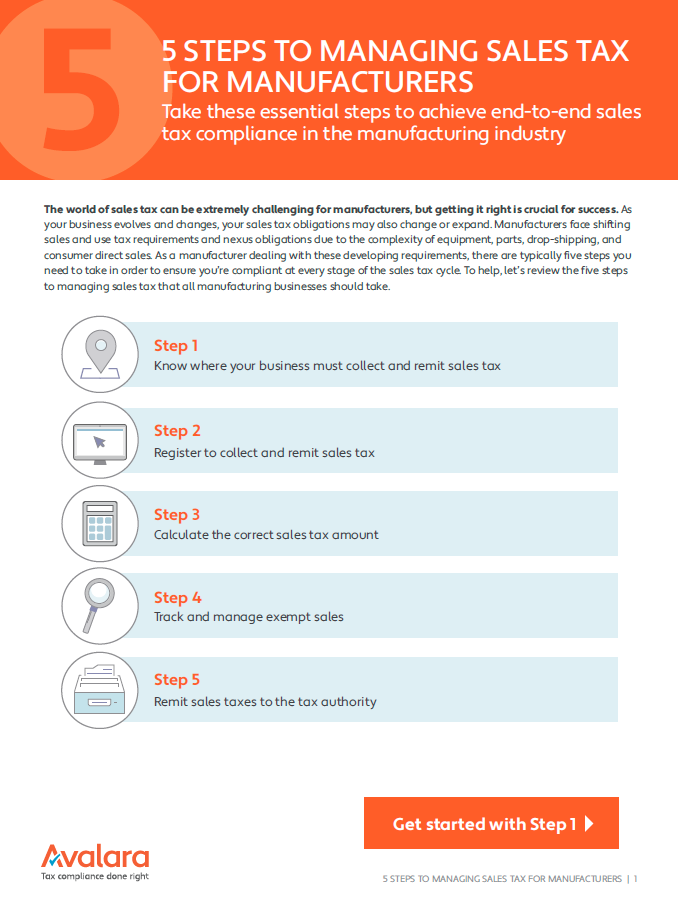

Sales tax is challenging but even more so for manufacturers, but getting it right is critical. Your sales tax obligations may change or expand as your business evolves. Manufacturers face shifting sales/use tax requirements and nexus obligations due to the complexity of equipment, parts, drop-shipping, and consumer direct sales.

Find out the five steps you need to take in order to ensure you’re compliant at every stage of the sales tax cycle – fill out the form below and download this whitepaper showcasing the five steps to managing sales tax that all manufacturing businesses should take.